In Direct Contravention to the Positive Proclamations of the EC & IMF, Italy Again Pledges over 1% of GDP To Bail Out Its Banks

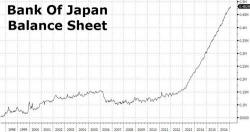

While we doubt anyone will laugh, we find it amusing that none other than arguably the "last holdout" of ZIRP and then NIRP, BOJ governor Haruhiko Kuroda, finally joined the chorus of people warning that low interest rates will "sow the seeds of the next financial crisis." Echoing concerns voiced by Deutsche Bank and virtually every other bank over the past year, Kuroda said that "a new challenge has emerged in the form of low profitability at financial institutions," adding that rapid growth in shadow banking and new financial technology were bringing big changes to the gl

After Credit Suisse reported yet another significant loss for the full year 2016, amounting to 2.35 billion Swiss francs, more than the CHF2.07bn expected, the Swiss banking giant said it was looking to lay off up to 6,500 workers and said it was examining alternatives to a planned stock market listing of its Swiss business.

Submitted by Jim Quinn via The Burning Platform blog,

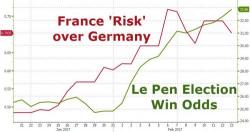

On Friday, after it emerged that as part of Marine Le Pen's strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would "amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012, threatening chaos to the world financial system on top of the collapse of the single currency."