Indonesia Terminates All Business Relationships With JPMorgan After Downgrade

We officially have a new definition ot "thin-skinned".

We officially have a new definition ot "thin-skinned".

For a glimpse into just how insane modern finance and capital markets are, look no further than Italy's thrice insolvent (in three years) bank Monte Paschi, which after failing to finalize a private, is finalizing the terms of its nationalization with the Italian government: a rescue which will cost Italian taxpayers at least €6.6 billion, and likely more.

Submitted by David Gordon via The Mises Institute,

Mervyn King is the British Ben Bernanke. An eminent academic economist, who now teaches both at New York University and the London School of Economics, King was from 2003 to 2013 Governor of the Bank of England. In short, he is a very big deal. Remarkably, in The End of Alchemy he frequently sounds like Murray Rothbard.

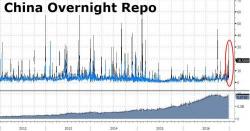

With the PBOC fighting tooth and nail to slow outbound capital flight, which according to Goldman has reached $1.1 trillion since August 2015, and which these days mostly means keeping the Yuan from depreciating to new all time lows below 7 Yuan to the Dollar, the Chinese central bank may have its work cut out for it in the immediate future. The reason is that, as Bloomberg reminds us, the first day of 2017 is when an annual $50,000 quota to convert the yuan into foreign exchange resets, stoking concern there will be a rush to sell the local currency.

While Deutsche Bank has had a generally terrible year, with its stock price plunging to all time lows on capitalization (and, at times, liquidity) concerns following the now concluded episode of its RMBS fine which the bank settled last week for roughly $7 billion of which just over $3 billion in actual cash payments, well below Wall Street's worst case scenario, another far more important open item was whether DB executives and staffers would receive a bonus in a year in which markets seriously wondered if the biggest European bank would get a government bailout.