Over The Last 10 Years The US Economy Has Grown At Exactly The Same Rate As It Did During The 1930s

Authored by Michael Snyder via The Economic Collapse blog,

Authored by Michael Snyder via The Economic Collapse blog,

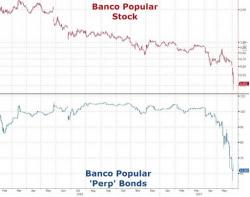

Even as attention has turned once again to Italy as the next possible source of European financial contagion, Spain's sixth largest bank has found itself in freefall over the past few days as concerns grow that the bank may be liquidated unless a last-minute buyer, or source of capital, emerges.

After months of "smoking guns" and conspiracy theory dismissals, a Singapore-based Deutsche Bank trader (at the center of fraud allegations) finally confirmed (by admitting guilt) what many have suspected - the biggest banks in the world have conspired to rig precious metals markets.

After last month's "much stronger than expected" jobs report, Goldman was convinced that the Fed would hike in June and September, while disclosing its balance sheet tapering announcement in December. However, after today's disappointing jobs report, Jan Hatzius has flipped the last two, and says that he "now expects the third hike of 2017 to occur at the December meeting (we previously expected a hike in September and a balance sheet in announcement in December)."

If May was supposed to be the "tiebreaker" month, after a disastrous March and a solid (if now downward revised) April, then the US economy is not doing well: with only 138K jobs added in the past month, while over 200K actual jobs were lost (per the Household Survey), it was no surprise that the biggest missing link of the so-called recovery, wage growth, was simply not there again.

How is it that with the labor market supposedly near full employment, and the unemployment rate sliding to a post 2001 low of 4.3%, wages simply can not rise?