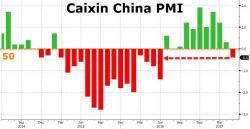

China Manufacturing Contracts For The First Time In A Year: "The Economy Is Clearly On A Downward Trajectory"

Following yesterday's official (if less credible and focused mostly on SOEs) manufacturing and non-mfg PMI reports from China's National Bureau of Statistics, both of which came either in line or slightly better than expected, moments ago Caixin/Markit reported its own set of Chinese manufacturing data, and it was far more disappointing: at 49.6, not only did it miss expectations of 50.1, but by printing below 50, the operating conditions faced by Chinese goods producers deteriorated for the first time in nearly a year.