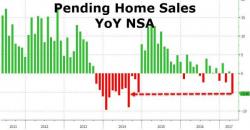

Pending Home Sales Crash Most In 3 Years, Hit By "Double Whammy" Of Price, Inventory

Signed contracts in April tumbled 5.4% YoY (NSA). This is the biggest drop in pending home sales since August 2014 and comes on the back of last week's disappointing housing 'recovery' data as perhaps Fed- and Trump-driven mortgage-rate rises have finally hit the American 'pocketbook'.

This is the second monthly drop in a row (-1.3% MoM) and comes with downward revisions for the last few months.