Fitch Warns Biggest Threats To The Dollar's Global Supremacy Are At Home

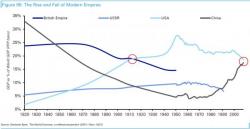

The US dollar will almost certainly remain the world's most important reserve currency for the foreseeable future but the lack of a ready substitute does not mean the dollar's current position is entirely assured, says Fitch Ratings in its latest Global Perspectives commentary.