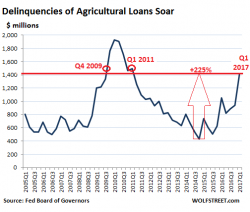

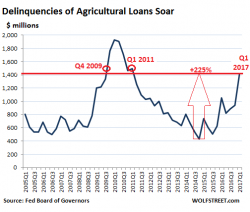

Commodities Bust Hits Farm Lenders, Delinquencies Surge 225%

Submitted by Wolf Richter via WolfStreet.com,

Just as the deflating Farmland bubble leaves its marks.

Submitted by Wolf Richter via WolfStreet.com,

Just as the deflating Farmland bubble leaves its marks.

This is not how it's supposed to work...

"Buy low, Sell high" they say. But in the new normal of risk-parity strategies, momentum igniters, and trend-following CTA flows, its "Buy high, buy more higher... and never sell until you're forced to liquidate"

Amid the longest period of low volatility complacency in US stock market history, which saw realized volatility and VIX (expectations for future volatility) collapse to near-record lows...

Submitted by Daniel Ruiz via Blinders Off blog,

The Perfect Storm

The following topics all have their part in fueling the storm to come:

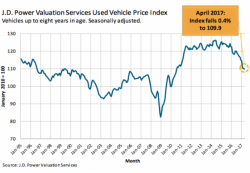

1) Trade Cycles and How They Affect New Vehicle Sales Velocity

Authored by Chris Campbell via LFB.org,

“Progressive” is often a word we hear bandied about to describe very destructive things.

It’s “progressive,” for example, to believe taking responsibility for your individual thoughts, words and actions is a fool’s errand. When taken to its extreme, as it often is, many self-described progressives believe you are responsible for the actions, past and present, of your “group” — and such group, whether you like it or not, is decided for you without your input.

Authored by Lance Roberts via RealInvestmentAdvice.com,

A recent article out this past week by Russ Koesterich via BlackRock noted that bond yields had not melted-up as “everyone expected.”

Sorry, Rick.

It’s not everyone, just you guys on Wall Street.

Since 2013, I have been laying out the case, repeatedly, as to why interest rates will not rise. Here are a few of the most recent links for your review: