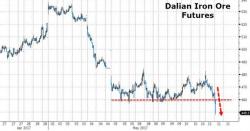

China Iron Ore Prices Crash Through Key Support To 6-Month Lows

After a few short days of respite - suggested by some as indicative that the worst is over - China commodities are crashing again tonight with Dalian Iron ore snapping below 460 to its lowest since before Trump's election...

This has erased the entire post-Trump reflation trade hope...