Stocks - Breakout Or Fakeout?

Authored by Lance Roberts via RealInvestmentAdvice.com,

In this past weekend’s newsletter, I discussed the relatively “weak” breakout of the market to new record highs. To wit:

Authored by Lance Roberts via RealInvestmentAdvice.com,

In this past weekend’s newsletter, I discussed the relatively “weak” breakout of the market to new record highs. To wit:

Authored by David Yager via OilPrice.com,

The current discussion about the future of oil is how soon will it be before petroleum becomes a sunset industry. If it isn’t already. Flat or falling demand. Carbon taxes. Electric cars. Renewable energy. Oil has no future. It is only a matter of time, although how much time remains is subject to considerable discussion and debate. Various prognosticators put forth differing view about when world oil demand will peak. Some say as early as 2030, others much later. Nobody says never.

"Iron ore doesn't have good fundamentals," warns one analyst as while the crackdown on leverage in Chinese capital markets (which has tightened liquidity everywhere) is the immediate catalyst, "supply-side pressure is huge as ever, and mills are still seeking to draw down inventories."

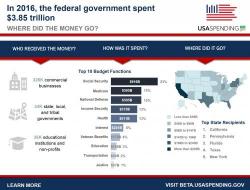

Despite paying trillions in Federal taxes every year, Americans' requests for a clear, detailed breakdown of where their money goes every year, have gone unanswered and been ignored by both Republican and Democrat administrations for one simple reason: transparency has an unpleasant way of mutating into accountability, which is the scariest thing imaginable for any career politician.

Not any more.

It's deja vu all over again.