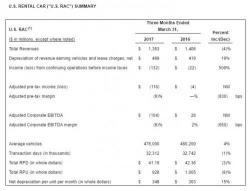

Hertz Plunges 14% After Reporting Abysmal Earnings

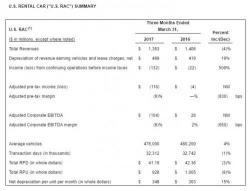

Since President Trump met his Candian counterpart Justin Trudeau in mid-February, speculators have piled into bearish Canadian Dollar positions.

In fact, between imploding housing bubbles, crashing oil prices, and escalating trade wars, bets on a battered Loonie have never been higher...

The Loonie is the worst-performing major currency this year...

Authored by Wolf Richter via WolfStreet.com,

Undercutting competition by burning unlimited amounts of investor cash is part of the business model.

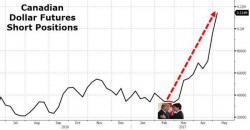

While China 'ripples' are top of mind for professional investors currently (though you would not know it from the constant AAPL, AMZN, NFLX chatter on mainstream business media), RBC's head of cross-asset strategy Charlie McElligott takes a step back to look at the overall picture once again.

China's deleveraging is hitting everything - how long before it 'ripples' across the Pacific? Or will the PBOC fold and inject liquidity?

Who could have seen this coming?

We have noted the stark divergence between still robust expectations/ surveys/ confidence (soft data) and relatively weak final sales/ production/ spending (hard data) numerous times in the past few months.

But note how the recent collapse in “soft” upside surprises has totally eliminated this gap.

This is relatively straight forward to explain in context. Both the underlying macro data change and consensus indices for soft data were running at post GFC highs at the end of March/early April.