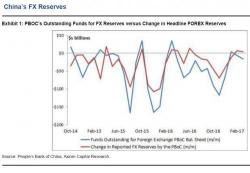

China Resorts To “Old School” Tactics To Support Inflows

Submitted by Gordon Johnson of Axiom

Is the PBoC “Tweaking” the FX Reserve Data to Improperly Show Foreign Inflows?

Over the past 30 months when the PBoC sold/brought dollars (evidenced by a m/m decline in PBoC funds outstanding for FX), 66.7% of the time reported FX reserves fell/rose.