Betting Against A June Rate Hike? Something's Going On

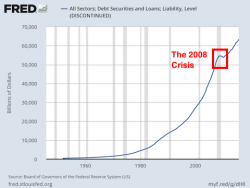

We noted yesterday that the recent trend of increased volumes into Eurodollar future out-months was 'odd'...

But the sudden surge in interest in Eurodollar calls (vs puts) suggests more than just a few prop bets are being placed on the fact that The Fed does not hike rates in June.