![]()

See this visualization first on the Voronoi app.

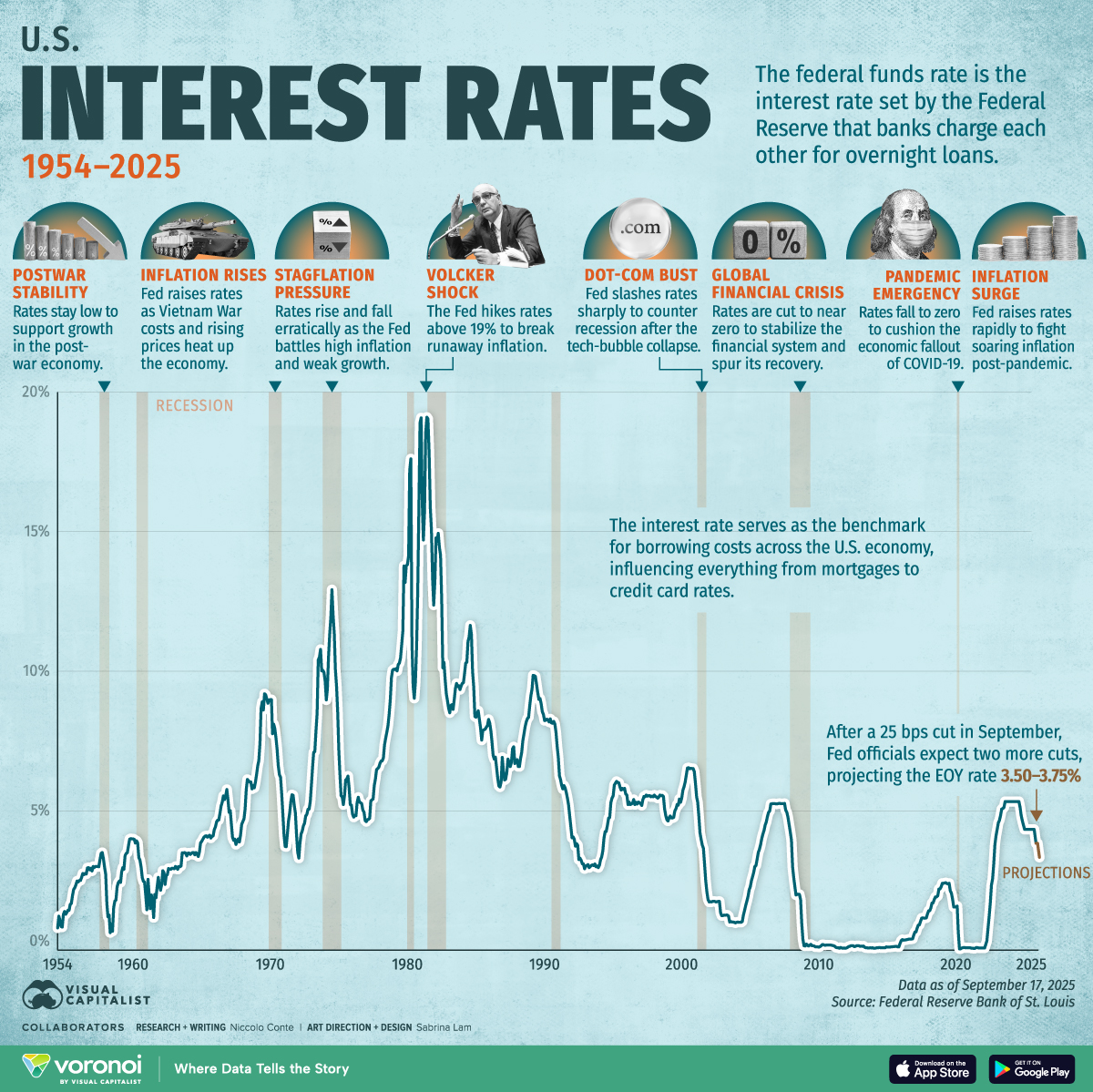

The U.S. Interest Rate Over Time (1954-2025)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- The U.S. interest rate has fluctuated considerably over the decades, reaching above 19% during the early 1980s and later falling to near zero in the 2008 financial crisis and COVID-19 pandemic.

- The Federal Reserve made their first interest rate cut of this year of 25 basis points on September 17th, and projects rates to decline to 3.50–3.75% by the end of 2025.

In the U.S., raising or lowering the interest rate is one of the Federal Reserve’s most powerful tools for shaping the economy. It influences everything from borrowing costs for households to global capital flows.

With the Federal Reserve cutting the interest rate for the first time in 2025 this week, this graphic takes a look back at how this cut and rate projections to the end of 2025 look in historical perspective.

This chart shows how the Federal Funds Rate has changed from 1954 to September 2025 with projections through the end of 2025, using data from the Federal Reserve and their latest Summary of Economic Projections.

How the Interest Rate Has Changed Since 1954

Over the past seven decades, the U.S. interest rate has moved through cycles of extreme highs and historic lows.

The table below includes the data of the average interest rate each year since 1954, with the 2025 average including the Federal Reserve’s projections of two additional cuts by the end of the year.

| Year | U.S. Average Interest Rate |

|---|---|

| 1954 | 1.01% |

| 1955 | 1.79% |

| 1956 | 2.73% |

| 1957 | 3.11% |

| 1958 | 1.57% |

| 1959 | 3.31% |

| 1960 | 3.22% |

| 1961 | 1.96% |

| 1962 | 2.71% |

| 1963 | 3.18% |

| 1964 | 3.50% |

| 1965 | 4.08% |

| 1966 | 5.11% |

| 1967 | 4.22% |

| 1968 | 5.66% |

| 1969 | 8.20% |

| 1970 | 7.18% |

| 1971 | 4.66% |

| 1972 | 4.43% |

| 1973 | 8.73% |

| 1974 | 10.50% |

| 1975 | 5.82% |

| 1976 | 5.05% |

| 1977 | 5.54% |

| 1978 | 7.93% |

| 1979 | 11.19% |

| 1980 | 13.36% |

| 1981 | 16.38% |

| 1982 | 12.26% |

| 1983 | 9.09% |

| 1984 | 10.23% |

| 1985 | 8.10% |

| 1986 | 6.81% |

| 1987 | 6.66% |

| 1988 | 7.57% |

| 1989 | 9.22% |

| 1990 | 8.10% |

| 1991 | 5.69% |

| 1992 | 3.52% |

| 1993 | 3.02% |

| 1994 | 4.20% |

| 1995 | 5.84% |

| 1996 | 5.30% |

| 1997 | 5.46% |

| 1998 | 5.35% |

| 1999 | 4.97% |

| 2000 | 6.24% |

| 2001 | 3.89% |

| 2002 | 1.67% |

| 2003 | 1.13% |

| 2004 | 1.35% |

| 2005 | 3.21% |

| 2006 | 4.96% |

| 2007 | 5.02% |

| 2008 | 1.93% |

| 2009 | 0.16% |

| 2010 | 0.18% |

| 2011 | 0.10% |

| 2012 | 0.14% |

| 2013 | 0.11% |

| 2014 | 0.09% |

| 2015 | 0.13% |

| 2016 | 0.40% |

| 2017 | 1.00% |

| 2018 | 1.83% |

| 2019 | 2.16% |

| 2020 | 0.38% |

| 2021 | 0.08% |

| 2022 | 1.68% |

| 2023 | 5.02% |

| 2024 | 5.14% |

| 2025 | 4.21% |

In their most recent interest rate announcement on September 17, 2025, the Federal Reserve announced their first interest rate cut of 2025 of 25 basis points (bps).

The Federal Reserve’s Summary of Economic Projections was released alongside the announcement, where more than half of the board members projected at least an additional two 25 bps rate cuts this year.

If these further rate cuts were to manifest, the interest rate would move down from its current target range of 4.00–4.25% to 3.50–3.75%.

The Volcker Era and Double-Digit Rates

The early 1980s marked the most dramatic spike in interest rates.

With inflation climbing into double digits but economic growth slowing (also known as stagflation), the Fed pushed rates above 19%, triggering a recession but eventually restoring price stability.

This remains the highest point in the modern history of U.S. interest rates, and is known as the “Volcker Shock”: when Federal Reserve Chair Paul Volcker broke the back of rising inflation.

The 2008 Financial Crisis and Pandemic Era’s Near-Zero Rates

In the aftermath of the global financial crisis, the Fed slashed the interest rate to almost zero. By December 2008, the effective Federal Funds Rate had fallen to the lowest positive range of 0.00–0.25%.

This was the start of a prolonged period of ultra-low interest rates that lasted nearly a decade. While the Federal Reserve had engaged in raising the interest rate back up from late 2015 to 2019, the COVID-19 pandemic forced the Fed to return to near-zero rates.

During this stretch, the interest rate was slashed to the 0.00–0.25% target range to provide liquidity and a more supportive economic environment amidst an unprecedented global shutdown.

Not long after, the interest rate was rapidly raised in 2022–2023 to a high range of 5.25–5.50% to combat the sharpest surge in inflation in 40 years.

Three rate cuts at the end of 2024 brought the interest rate down to the 4.25–4.50% range for most of 2025, before this most recent cut.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out how U.S. interest rate cuts compare with other G7 countries on Voronoi, the new app from Visual Capitalist.