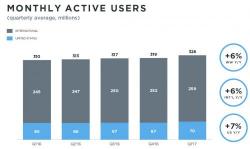

Twitter Surges After Beating Expectations, MAUs Jump Despite Revenue Slowdown: The Quarter In Charts

For once Twitter did not disappoint Wall Street, when moments ago it reported results that beat consensus estimates handily as non-GAAP EPS of $0.11 beat consensus of $0.02, even topping the highest estimate of $0.10, on revenue of $548.3 million, also beating est. of $509 million (just don't look at the GAAP EPS loss of 8 cents). Helping the beat was a jump in monthly active users, which rose to 328 million, beating estimates of 322 million, on Q1 daily active usage up 14% y/y, higher than 11% in 4Q and 3% in 1Q16.