![]()

See this visualization first on the Voronoi app.

How Exposed are Canadian Cities to Tariff Risk?

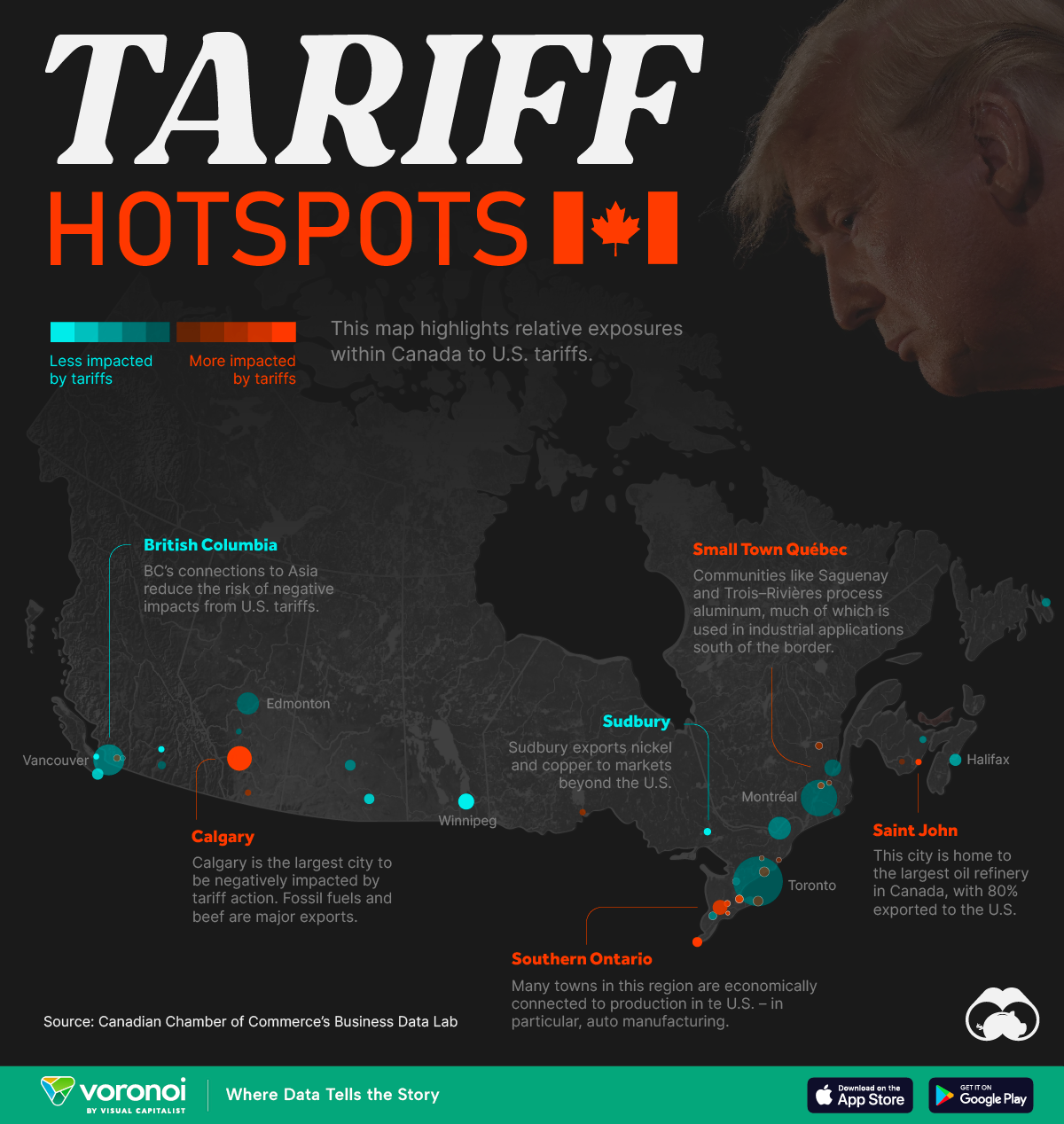

After a month-long pause, proposed U.S. tariffs are once again casting a long shadow over Canada. While the economy will take a hit with the tariffs from the Trump Administration in effect, negative impacts will not be felt equally across the country. Specific cities and sectors are facing disproportionate risk.

This map, with data from the Canadian Chamber of Commerce Business Data Lab (BDL), is an overview of which Canadian cities are likely to be the hardest hit by tariffs.

Here’s the full data from the Tariff Exposure Index:

| City | GDP (billions) | Tariff Exposure Index |

|---|---|---|

| Saint John | 7 | 131.1% |

| Calgary | 115 | 81.6% |

| Windsor | 18 | 61.7% |

| Kitchener–Waterloo | 37 | 43.0% |

| Brantford | 7 | 27.8% |

| Guelph | 12 | 24.0% |

| Saguenay | 10 | 23.5% |

| Hamilton | 41 | 19.8% |

| Trois-Rivières | 8 | 18.9% |

| Lethbridge | 7 | 15.7% |

| Belleview | 6 | 14.4% |

| Drummondville | 5 | 12.1% |

| Thunder Bay | 7 | 11.2% |

| Oshawa | 15 | 11.0% |

| Abbotsford–Mission | 9 | 7.6% |

| St. Catharine's–Niagara | 19 | 5.4% |

| Peterborough | 5 | 4.5% |

| Fredericton | 6 | 4.2% |

| Barrie | 10 | 0.7% |

| Chilliwack | 5 | –1.2% |

| Red Deer | 6 | –3.8% |

| Sherbrooke | 10 | –5.6% |

| Montréal | 254 | –5.7% |

| Edmonton | 93 | –6.6% |

| Kingston | 10 | –6.9% |

| Québec City | 53 | –7.6% |

| Toronto | 473 | –8.4% |

| Kelowna | 12 | –9.9% |

| Ottawa–Gatineau | 99 | –10.9% |

| Moncton | 9 | –11.1% |

| London | 31 | –11.3% |

| Vancouver | 183 | –14.9% |

| St. John's | 14 | –15.5% |

| Saskatoon | 22 | –21.6% |

| Halifax | 27 | –35.1% |

| Victoria | 24 | –40.1% |

| Regina | 20 | –40.9% |

| Winnipeg | 48 | –50.6% |

| Nanaimo | 6 | –60.6% |

| Kamloops | 7 | –78.1% |

| Sudbury | 10 | –82.0% |

Positive numbers indicate a greater risk, while negative numbers indicate less of an impact from tariffs.

Trump Tariff Risk in Canadian Cities

Southern Ontario is expected to bear the brunt of coming tariff action. Cities like Windsor, Hamilton, and Oshawa, deeply embedded in the automotive and steel sectors, face the prospect of job losses and economic slowdown if the trade spat grinds on too long. The steel and aluminum industries, targeted by the proposed tariffs, are central to this concern, with ripple effects expected throughout cross-border manufacturing supply chains.

Alberta is expected to feel the burn of tariffs as well. The province could take the biggest GDP hit in the short term, falling 1.4% in Q2 of 2024. Calgary, a major export hub for fossil fuels, has especially high risk of economic impacts. In addition to the oil and gas sector, Alberta’s cattle industry would get grilled by tariffs as the U.S. is the top export market for Canadian beef.

Specific communities in Québec, such as Saguenay and Trois-Rivières, face big risks in this coming trade war. For example, Saguenay is a key aluminum hub, with U.S. exports making up over one-fifth of the local economy.

Saint John, New Brunswick has the distinction of the being the most “tariff exposed” Canadian city. The city is home to the largest oil refinery in Canada, exporting 80% of its product to the United States.

In Vancouver, a more diverse set of trade partners, particularly in Asia-Pacific, minimizes the West Coast city’s vulnerability to U.S. tariffs. British Columbia’s relatively low reliance on U.S. goods exports (51% in 2024) provides further insulation. One major exception is in rural BC. Smaller communities, which are not covered in the BDL research, could face economic turmoil in a protracted trade war, particularly if logging is a major industry in town.

Looking Ahead

On the upside, there has been plenty of time for Canadian businesses and policymakers develop strategies to mitigate potential impacts. For now, all imports from Canada and Mexico will face a 25% tariff, with the exception of a 10% levy on Canadian energy. Canadian Foreign Minister Melanie Joly announced that retaliatory duties covering over $20 billion of goods are imminent.

The post How Exposed are Canadian Cities to Tariff Risk? appeared first on Visual Capitalist.