Here Is The Simplest Reason Why The Reflation Trade Is About To Fizzle

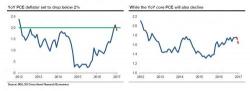

Forget Trump, forget China, forget oil, forget central banks unwinding their balance sheets, forget Reuters trial balloons: there is a far simpler reason why the 'reflation trade' is about to hit a major pothole.