Volatility: A Misleading Measure Of Risk

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

“History has not dealt kindly with the aftermath of protracted periods of low risk premiums” – Alan Greenspan

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

“History has not dealt kindly with the aftermath of protracted periods of low risk premiums” – Alan Greenspan

"Someone's liquidating" warns one veteran energy trader as the sudden heavy volume surge to the downside in WTI crude futures smashes oil prices back to the lowest since August 2016.

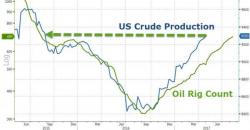

Surging US crude production (once again to August 2015 highs)...

And demand forecasts are tumbling:

And loss of faith from the hedge fund community..

and this is what OPEC gets...

"Something is off," warns RBC's head of cross-asset strategy Charlie McElligott in the introduction to his latest market noting that the swing in US fiscal policy optimism is coming at a critical time as the China's liquidity tightening is spooking the reflation story.

SUMMARY:

The Subprime 2.0 story is now gaining traction in the financial media.

By way of brief review, here is the template for Subprime 1.0 (the mortgage meltdown).

1) Banks, hungry for profits, began issuing mortgages to sub-prime borrowers (people who couldn’t possibly pay the loans back).

2) Housing prices and sales began to fall.

3) Subprime borrowers began defaulting on their mortgage.

4) Subprime mortgage lenders began to collapse.

5) A crisis unfolds as the issue spreads throughout the banks.

Four days ago we reported that bitcoin has surged above $1,400, hitting a new lifetime high, while rising above $1,500 on certain Chinese exchanges. Since then, bitcoin's latest exponential rise has only accelerated, and moments ago the price of the cryptocurrency surged as high as $1,600 on the Coinbase exchange, rising as high as $1,655 on the troubled Bitfinex exchange.

What is prompting this relentless surge in Bitcoin?

Several things.