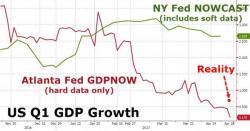

Global Reflation Trade In Trouble: Chinese Economic Data Plunges To 6-Month Lows As New Orders Dry Up

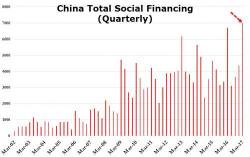

New Orders for Manufacturing and Services sectors of the economy tumbled to their lowest levels in at least 6 months, weighing down both PMIs to their lowest levels since October 2016. After Q1's record surge in new credit creation, it appears the rapid tightening in China's financial conditions is already having an impact on the real economy (as well as the bond and stock market).