Is The World's Largest Bitcoin Exchange Headed For A Mt. Gox-Style Collapse

Could Bitfinex, the world's largest, Hong-Kong based cryptocurrency exchange, be headed for a Mt. Gox-style collapse? It's starting to look that way.

Could Bitfinex, the world's largest, Hong-Kong based cryptocurrency exchange, be headed for a Mt. Gox-style collapse? It's starting to look that way.

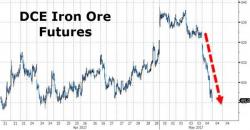

It seems Kyle Bass' warning was extremely timely. The deleveraging of China's $4 trillion shadow banking system just accelerated massively as Bank Wealth Product Issuance crashes 15% month-over-month. With stocks and bonds already plunging, commodities joined the ugliness tonight with Dalian Iron Ore limit down (8%) at the open (not helped by tumbling auto demand).

As Bloomberg reports, China April Bank Wealth Product Issuance Falls 15% M/m

Authored by Kevin Muir via The Macro Tourist blog,

The other day, fabled hedge fund manager Paul Tudor Jones made headlines when he issued a bold warning to Janet Yellen & Co. (from Bloomberg):

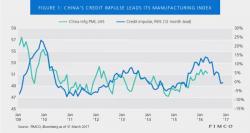

Authored by Gene Frieda via PIMCO's blog,

Following the defeat of the new U.S. healthcare bill, investors have begun to rethink the likely time frame and extent of the Trump administration’s other top priorities, such as fiscal stimulus. Equity markets stalled and bonds rallied as investors toned down their expectations for global reflation recently.

Authored by Michael Snyder via The End of The American Dream blog,

There has been a tremendous amount of talk about the spending deal that was just reached in Congress. Most of the focus has been on who “won” and who “lost” politically, and if you have been keeping up with my articles you definitely know my opinion on the matter.