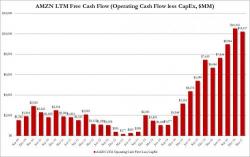

Amazon Soars To New All Time High After Smashing Expectations

After two consecutive quarters of disappointing earnings reports (which however failed to keep the stock down), AMZN is back to its beating ways, reporting both revenue and EPS which blew away expectations. In the first quarter, Amazon reported earnings of $724 million or $1.48 per share, a 41% increase in quaraterly profit, and some 40 cents above the consensus estimate of $1.08, on net sales of $35.71 Billion, also higher than the estimate of $35.3 Billion, and up from $19.2 billion.

What Does Elemetal Imply for Precious Metals?

What Does Elemetal Imply for Precious Metals?