Wall Street Is Pouring Money Back Into Shale

Authored by Nick Cuningham via OilPrice.com,

With oil prices seemingly on firm footing, Wall Street is pouring money back into the shale sector, expecting profits even at $50 per barrel.

Authored by Nick Cuningham via OilPrice.com,

With oil prices seemingly on firm footing, Wall Street is pouring money back into the shale sector, expecting profits even at $50 per barrel.

Goldman Sachs' Charlie Himmelberg and Marty Young find evidence that "animal spirits" are driving sentiment along party lines... and that may be a concern...

Interested in precious metals investing or storage? Contact us HERE

The Great Western Economic Depression

Written by Jeff Nielson (CLICK HERE FOR ORIGINAL)

Despite last week's unexpected crude draw (and product draws) WTI/RBOB has faded since (even with a lower dollar) as OPEC production cut questions trump inventories for now. However, prices tumbled immediately after API report a smaller than expected draw in crude (-840k) and an unexpected build in gasoline (+1.37mm) .

API

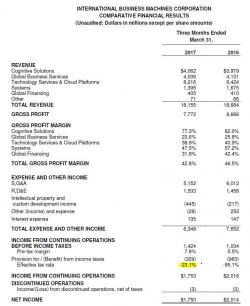

Last quarter, IBM almost fooled the market when it "beat" but only thanks to using the lowest effective tax rate in recent history (excluding one charge-fulled quarter when the rate was negative).