"It's All About Oil Now": Citi Charts The Biggest Risk To The Global Reflation Trade

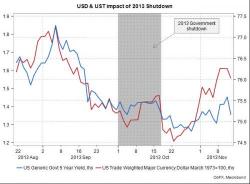

Despite today's surge in global equities, which may be as much driven by the France relief rally as the unwind of recent hedges, the latest attempt to reignite the reflation rally is fading as US Treasury yields have given up on much of the overnight move, following two weaker than expected "soft data" reports, the CFNAI and Dallas Fed, released earlier today.