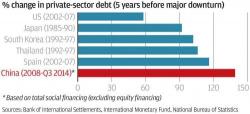

China’s Credit Excess Is Unlike Anything The World Has Ever Seen

By Andrew Brown, a partner for macro and strategy at ShoreVest Capital Partners

From a global macroeconomic perspective, we encourage readers to consider that the world is experiencing an extended, rolling process of deflating its credit excesses. It is now simply China’s turn.