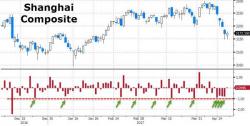

A New "Anomaly" Emerges In Chinese Markets

The Shanghai Composite Index, notorious for its wild swings over the past two years, has gone 85 trading days without a loss of more than 1% on a closing basis, the longest stretch since the market’s infancy in 1992.

The last 4 days have highlighted the unusual effect in Chinese stocks.. each time the Shanghai Composite dropped over 1% (red dotted line) it was miraculously lifted to ensure it closed with a loss less than 1%...