#FordSchoolYellen Q&A Post-Mortem - Janet Yellen's Greatest Hits

Fed Chair Janet Yellen has just completed her Q&A with Twitter. She did not disappoint...

The Economy...

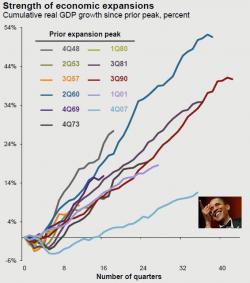

- *YELLEN: U.S. ECONOMY IS "PRETTY HEALTHY"

Worst economic recovery on record...

- *YELLEN: WE MUST SUSTAIN PROGRESS THAT WE HAVE ACHIEVED

Current Quarter GDP forecast 0.6%...