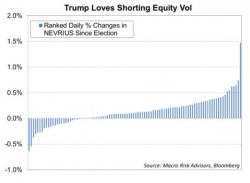

Goldman Highlights A Significant Debt-Equity Disconnect And How To Trade It

In early March, Goldman's John Marshall looked at the firm's proprietary macro hedging indicator and found something peculiar: investors were buying stocks and discarding protection. As Marshall said at the time, this was a reflection of "How Trump Changed the Market", and said added that "the cost of liquid long-dated hedges in equity and credit has collectively reached its lowest level in six years following the decline this week. The last time macro hedge costs were near this level across assets was in July 2015."