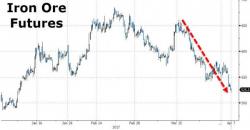

Iron Ore Prices Plunge Into Bear Market Amid Record China Glut

Just a week ago we warned of China's record glut of Iron Ore (enough to build 13,000 Eiffel Towers), and following warnings from Barclays and RBA of a likely pullback, futures in Dalian sank to lowest since November as steel sags.