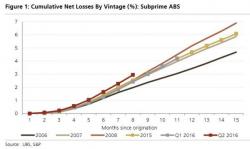

Morgan Stanley Warns Auto Market Exhibiting "Classic Signs of Cyclical Fatigue"

Earlier this morning, Morgan Stanley's auto team, led by Adam Jonas, offered up a sobering redux of the March auto sales figures released yesterday. Here is a brief recap of Jonas' key takeaways (hint: volume down, incentives up, inventories up):

March auto sales data (16.6mm SAAR vs 16.8mm LY) featured a number of classic signs of a late cycle: falling volume, rising inventory and rising incentives. A drop in used prices may complicate matters.