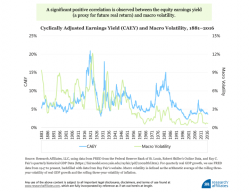

The CAEY Ratio & Forward Returns

Authored by Lance Roberts via RealInvestmentAdvice.com,

Authored by Lance Roberts via RealInvestmentAdvice.com,

Earlier this morning, Morgan Stanley's auto team, led by Adam Jonas, offered up a sobering redux of the March auto sales figures released yesterday. Here is a brief recap of Jonas' key takeaways (hint: volume down, incentives up, inventories up):

March auto sales data (16.6mm SAAR vs 16.8mm LY) featured a number of classic signs of a late cycle: falling volume, rising inventory and rising incentives. A drop in used prices may complicate matters.

Authored by Valentin Schmid via The Epoch Times,

Macquarie strategist Viktor Shvets explains overcapacity, debt, and government intervention

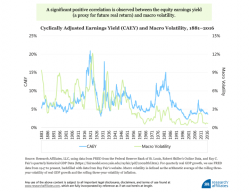

Despite the temporary injection of confidence in the American economy brought about by the election of President Donald Trump, major structural problems continue to lurk beneath the surface. These trends, decades in the making, are so entrenched and intractable that even Trump’s boldest plans may not be able to resolve them.

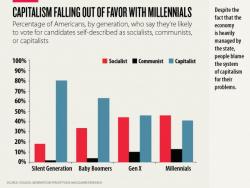

For months now we've been writing about the mysteriously rising subprime delinquencies afflicting auto ABS structures despite repeated confirmations from the Fed and equity markets that 'everything is awesome' (see "Auto Bubble Burst Begins As Subprime Delinquencies Soar To 2009 Levels" and "Signs Of An Auto Bubble: Soaring Delinquencies In These 266 Subprime ABS Deals Can't Be Good" for a couple of recent examples).

Shockingly, as confirmed by the chart below, 2016 vintage subprime auto ABS structures are even underperforming 2007/2008 vintage securitizations.

With oil surging back above $51 on hopes of a seasonal inventory drawdown, tonight's API data showed a bigger than expected draw in crude (biggest since 2016 and gasoline. The reaction was a kneejerk higher in WTI as RBOB slipped lower, but amid a big build at Cushing (+1.3mm), WTI also slipped.

API

Biggest draw of 2017 for crude but Cushing saw a notable build...