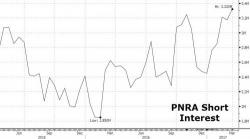

Shorts Crushed After JAB Acquires Panera In Largest Ever US Restaurant Deal

Luxembourg-based JAB Holdings, the acquisitive owner of Caribou Coffee, Peet's Coffee & Tea and Krispy Kreme, confirmed swirling speculation this morning when it announced it would acquire U.S. bakery chain Panera Bread for $315/share - a 20% premium - in a deal valued at about $7.5 billion. If completed, the transaction would mark the largest M&A deal for a US restaurant company, and the second-largest in North America after the 2014 acquisition of Tim Horton's.