Live: Jeff Gundlach Asset Allocation Webcast

It's that time of the month again where the "New Bond King" Jeff Gundlach, CEO of DoubleLine, sits down for his periodic open address to investors and the broader public, to discuss his latest views on the market and everything else.

As usual, we will present the full slideshow shortly after the presentation begins. Meanwhile, readers can sign up for the slideshow at the following link.

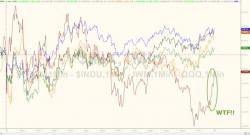

Gundlach starts off by talking about the "most coordinated global upturn in years"