Steve 'Big Short' Eisman: Smart, Lucky, Abrasive (& Now One Of Them)

Authored by Jim Quinn via The Burning Platform blog,

Authored by Jim Quinn via The Burning Platform blog,

Authored by Adam Taggart via PeakProsperity.com,

I don't talk to my classmates from business school anymore, many of whom went to work in the financial industry.

Why?

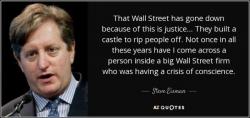

There are over 1.1 billion websites on the internet, but the vast majority of all traffic actually goes to a very select list of them. As Visual Capitalist's Jeff Desjardins notes, Google.com, for example, has an astounding 28 billion visits per month. The next closest is also a Google-owned property, Youtube.com, which brings in 20.5 billion visits.

Today’s infographic comes to us from Vodien, and it lists the 100 highest ranking websites in the U.S. by traffic, according to website analytics company Alexa.

That most distinct remnant of the 2006 housing bubble - home flipping - is not only back, it is more profitable than ever.

According to a new report by ATTOM Data Solutions and RealtyTrac,193,009 single family homes and condos were flipped — defined as sold in an arms-length transfer for the second time within a 12-month period — in 2016, up 3.1% from 2015 to the highest level since 2006, when 276,067 single family homes and condos were flipped.

Authored by Simon Black via SovereignMan.com,

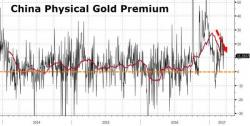

I serve on the Board of Directors of a large Singapore-based company that’s in the gold and silver business.

And, last night during our quarterly conference call, the management team gave me a lot of intriguing information.

Sales of physical gold and silver are collapsing across the entire industry.

At the US Mint, for example, sales of US Eagle gold coins fell by 67% between February 2016 versus February 2017.