Things Just Got Even Weirder

Via ConvergEx's Nicholas Colas,

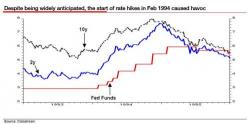

Just when you thought the 8 year bull market for US stocks had shown us everything, something new comes along.

Via ConvergEx's Nicholas Colas,

Just when you thought the 8 year bull market for US stocks had shown us everything, something new comes along.

That's not what the bankers want to hear...

Interestingly this comment comes after President Trump met with a group of community bankers...

And that is weghing on The Dow...

So, deregulation... after the big banks have been broken up by Glass-Steagal-lite?

That regulatory-premium in bank stocks has a long way to fall back to the curve...

Following the Trump presidential victory, two prominent macro strategists have undergone a significant change in their outlook: while David Rosenberg, who started off with a deflationary, and bearish outlook, then flipped to inflationary (and bullish), has recently once more "mean-reverted" and expects a further drop in yields as deflationary forces return, his SocGen peer, Albert Edwards - while still expecting a deflationary "ice age" in the longer-run (in case there is any confusion, he expressly states "make no mistake.

Via Charles Hugh-Smith of OfTwoMinds blog,

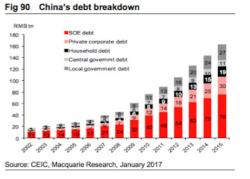

Eight years after the crisis of 2008-09, central banks are still injecting $200 billion a month into the global financial system to keep it from imploding.

If you want a central banker to choke on his croissant, read him this quote from socio-historian Immanuel Wallerstein: "Countries (have lost the ability) to control what happens to them in the ongoing life of the modern world-system."

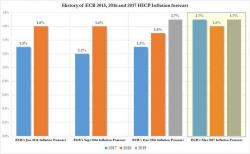

Update: the all-important inflationary forecast has been raised modestly, as follows: 2017 from 1.3% to 1.7%, 2018 from 1.5% to 1.6%, 2019 kept unchanged at 1.7%. He also said the council will continue to look through changes in inflation if judged to have no implication for medium-term outlook for price stability, and notes that substantial degree of monetary accommodation is still needed. As usual, he adds that the "ECB stands ready to increase asset purchase program in terms of size, duration."