Q1 GDP At Risk As Wholesale Inventories Tumble Most In A Year

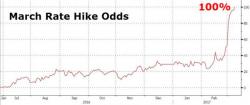

After surging in November and December, January's final wholesale inventories print showed a 0.2% decline - worse than expected and the weakest since Feb 2016. This negative 'hard' data point just piles on the weakness being forecast for Q1 GDP (but don't let that stop The Fed hiking).

Nov/Dec saw the "if we build it, they will come" economy surge in inventories on Trump hope...

But they didn't - Wholesale sales tumbled 0.3% in January... (though we note YoY, sales rose significantly thanks to that spike in December)