Graham Summers’ Weekly Market Forecast (Inflation Edition)

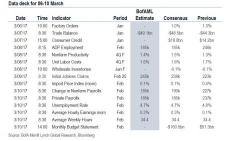

The simplest outline for this week concerns inflation.

Stocks have erupted higher in the last month based on the belief that the economy is roaring once again. However, this is all about sentiment, not reality. The Fed’s own real-time GDP tracking tools has collapsed from predicting growth of 3.5% in early February to just 1.9% last week.

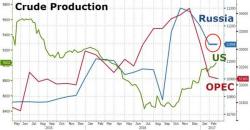

While “growth” isn’t coming anytime soon… INFLATION is.