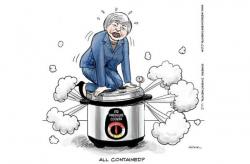

Bank Of Tokyo's Chris Rupkey Snaps At Janet Yellen's "Water Torture"

After years of listening to Bernanke and then Janet Yellen, it is no surprise that some have finally snapped, as Bank of Tokyo-Mitsubishi UFJ's Chris Rupkey appears to have done in his post-Yellen, post-mortem.

Breaking economy news. If you were looking for a signal that a Fed rate hike was imminent, you would be hard-pressed to find any urgency to respond with a Fed rate hike on March 15 in Fed Chair Yellen's Chicago speech today.