Why You Should Be Nervous About Janet Yellen’s Speech Tomorrow

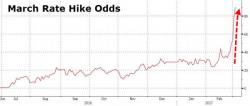

While virtually all prominent market commentators, most recently Bloomberg's Mark Cudmore, now seem convinced that the Fed will hike by 25bps on March 15, when just as recently as a week ago the question was June or September, some are still skeptical.