Crude Oil; Dangerous kiss of resistance in play?

Let me be clear about this, the trend over the last year in Crude Oil is up as it has created a series of higher lows and higher highs.

Let me be clear about this, the trend over the last year in Crude Oil is up as it has created a series of higher lows and higher highs.

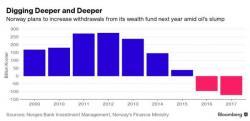

After previously announcing plans to withdraw at least $15 billion to fund 2017 budget deficits, the $860 billion Norwegian sovereign wealth fund announced last December that it would change it's portfolio allocations to try to make up for the withdrawals. The change would eventually result in 75% of the fund's capital being allocated to global equities, up from the previous 60% allocation...you know, because equities never go down so more is always better.

In a note by Evercore ISI's Terry Haines and Ernie Tedeschi, the analyst duo pours cold water on Trumps' budget proposal before it has been even formalized and confidently predicts that "Trump budget not happening" adding that the most likely outcome is that "Congress will modestly hike defense and non-defense spending."

Below is a summary of their thinking:

For the latest glimpse of the euphoria in the equity market, look no further than the Snap(chat) IPO, whose order book closes at noon today and is expected to price tomorrow, March 1, after the close. While the initial price range was presented as $14-16, according to Bloomberg orders for the public offering are concentrating in the $17-18 range, well above the high end of the range.

Continuing the trend of 'soft' survey data strong performance and expectation beats, The Conference Board's Consumer Confidence surged above the highest analyst's expectation to 114.8 - the best print since July 2001.

Consumers’ assessment of current conditions held relatively steady in February. Those saying business conditions are “good” declined slightly from 29.0 percent to 28.7 percent, while those saying business conditions are “bad” also decreased, from 15.9 percent to 13.2 percent.