Dr. Doom's Back: Marc Faber Warns Markets Will Fall "Like An Avalanche... Trump Can't Stop It"

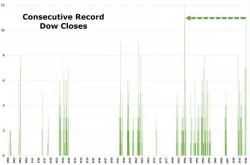

"One man alone cannot make 'America great again'. That you have to realize," warns Marc Faber, the editor of "The Gloom, Boom, & Doom Report," reminding the world that the US stock market is vulnerable to a seismic sell-off that won't be caused by any single catalyst. His argument: Stocks are very overbought and sentiment is way too bullish for the so-called Trump rally to continue.

http://player.cnbc.com/p/gZWlPC/cnbc_global