Is This Overlooked Statistic Signaling Investor Complacency?

Via Dana Lyons' Tumblr,

The number of unchanged issues on the NYSE has spiked, often a sign of complacency among investors.

Via Dana Lyons' Tumblr,

The number of unchanged issues on the NYSE has spiked, often a sign of complacency among investors.

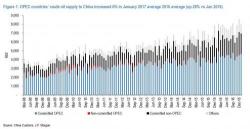

To those cynics who accuse the self-monitoring OPEC, and its various adjunct agencies, of lying that it has implemented last year's agreed upon production cuts, China just released January crude import data, which validates this skepticism.

The US oil rig count rose once again this week (up 5) to 602 - the highest since October 2015.

US crude production is surging - back above 9 million barrels/day in the last week - the largest since April 2016.

The lagged response to rig count builds implies considerably more production to come.

Bank of America's chief investment strategist remains bullish.

In his latest Flow Show note, Michael Hartnett, who several weeks ago penned the term "Icarus Trade" to describe what is happening to the market, writes that "we remain long risk in H1 targeting SPX 2500, oil $70/b, GT30 3.5%, DXY 110 (in that order sequentially); note Bull & Bear Indicator up to 7.0 (Chart 1), needs stronger EM/HY inflows & lower cash levels to trigger contrarian “sell” signal (>8.0)"

Not all is well in the luxury segment of the US housing market, manifested best through Manhattan's luxury condo segment, where as reported here over the last few months, there has been a sharp deterioration. A quick sampling of recent stories on the topic reveals that the situation is indeed bad, and getting worse: