Dow, VIX, Gold All Up As Yet Another Ratio Screams "Record High"

This market reminds us of this..."none shall fall"

Gold remains 2017's biggest gainer, oil is down, bonds flat and the panic bid this week dragged The Dow higher...

This market reminds us of this..."none shall fall"

Gold remains 2017's biggest gainer, oil is down, bonds flat and the panic bid this week dragged The Dow higher...

Submitted by Lance Roberts via RealInvestmentAdvice.com,

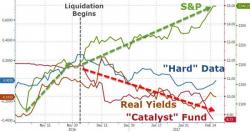

As discussed yesterday, the exuberance in the markets, as witnessed by the net positioning of large speculators, has reached records on both ends of the spectrum. Those extremes, combined with spiking levels of “hope” in both the financial and economic data is all too reminiscent of the past.

Japanese telecom giant Softbank - which owns Sprint - is reportedly looking at T-Mobile US for a merger. This would be the second attempt after 2014's approach was rebuffed by US regulators.

It appears the entire sector is bid on the news... even AT&T...

As Reuters details, SoftBank has not yet approached Deutsche Telekom to discuss any deal because the U.S. Federal Communications Commission has imposed strict anti-collusion rules that ban discussions between rivals during an ongoing auction of airwaves.

The Catalyst forced-buying is over; President Trump's honeymoon is nearing an end; so what happens next?

There is an 'odd one out' in the world...

The last few weeks have been unprecedented...

Bottom-up, Hope is becoming 'stretched'...

The 'Hard Data' is not backing that hope...

And where is the growth expectation that everything is hinging on?

Still, Buy The Fucking All-Time-High, right?

Submitted by Eric Bush via Gavekal Capital blog,

While the myth that stock market returns are highly correlated to a country’s GDP growth rate has largely been debunked, there remains a strong, and intuitive, relationship between corporate profits and GDP. GDP measures the output of an economy and corporate profits are simply the income to capital owners derived from that output (with some accounting adjustments made along the way). In the long-run, equity investors need to see growth in corporate profits in order to justify equity prices.