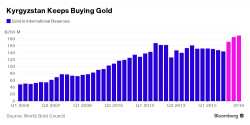

Every Citizen Should Own 3.5 Ounces of Gold Bullion - Central Bank

Every Citizen Should Own 3.5 Ounces of Gold Bullion - Central Bank

Every Citizen Should Own 3.5 Ounces of Gold Bullion - Central Bank

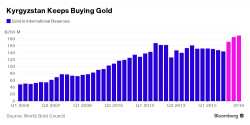

Finally some good news for active managers. After one year of consecutive outflows, last week saw the first inflows into long-only equity mutual funds going back to last February, as according to BofA there finally was a $0.5 billion cash inflow, "a sign of rising investor confidence & broadening participation in equity rally." However, to put this number in context, at the same time inflows to ETFs amounted to $17.2 billion, some 35 time more.

BofA's Michael Hartnett summarizes the latest fund flows in two words: "Risk-on."

S&P equity futures followed Asian and European stocks lower, driven by weakness in Franch and Italian markets, as French political concerns returned; the pound tumbled after UK monthly retail sales unexpectedly dropped pushing the dollar higher and Euro lower.

Submitted by Arthur Berman via OilPrice.com,

It is more likely that oil prices will fall below $50 per barrel than that they will continue to rise toward $70. Prices have increased beyond supply and demand fundamentals because of premature expectations about the effects of an OPEC production cut on oil inventories.

Last week’s 13.8 million barrel addition to U.S. storage was the second largest in history. It moved U.S. crude oil inventories to new record high levels.

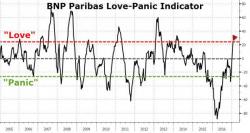

While the market itself has exhibited the exuberance we have all seen before (and never seem capable of learning from), BNP has quantified this love-panic relationship (and the news is not great for the bulls).