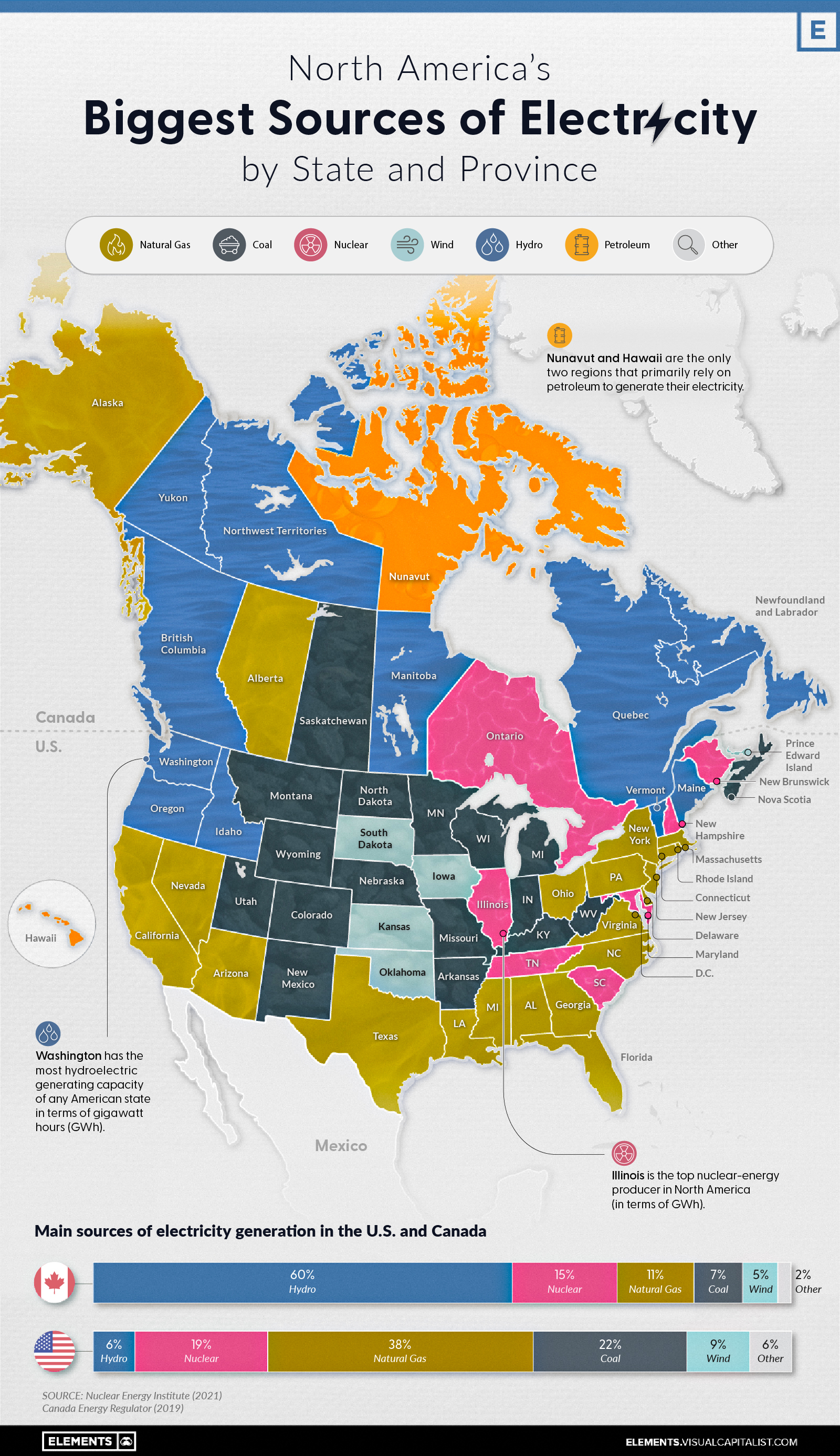

Mapped: Biggest Sources of Electricity by State and Province

Subscribe to the Elements free mailing list for more like this

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

Mapped: Biggest Sources of Electricity by State and Province