US Selloff Spooks Thinly Traded Global Markets Sending Stocks, Yields, Dollar Lower

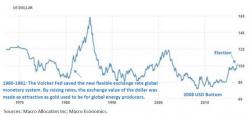

One day after the biggest drop in US stocks in over two months, taking the Dow ever further from the "promised" Dow 20000, global stocks struggled as they tried to close out 2016 on a positive note. The dollar dropped the most in two weeks, sliding alongside bond yields, while oil retreated from its highest close in 17 months as investors prepared to close out a volatile year for financial markets. European stocks slid from a 2016 peak, and extended losses for 2016 after briefly going green for the year.