The Fed Admits The Good Old Days Are Never Coming Back

Via MauldinEconomics.com,

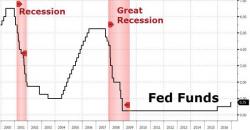

The dots that the FOMC members contribute to the plot indicate their expectations for the federal funds rate.

Technically, it’s what they think rates should be, not a prediction of what rates will be on those dates. Is that a forecast? You can call it whatever you like. I think “forecast” is close enough.

But before we analyze the whatever-you-call-it, let’s look back at the not-so-distant past.

A 5% risk-free return

Here’s a rate history of the last 16 years: