Global Shares Trade Mixed In Thin Holiday Trade; Yen Rises As China Rebounds

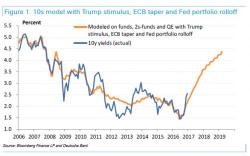

With most global market closed for Christmas holiday, and traders taking the day and the week off, global stocks traded mixed in thin, subdued conditions as the dollar dipped against the yen, with the USDJPY sliding for a fourth straight day to 117, while the EUR was flat at 1.0450, taking stock of the US 10Y yield which closed lower on Friday.