Mass Deception

Submitted by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Janet Yellen

Submitted by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Janet Yellen

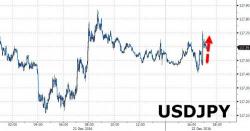

With Bitcoin at 3 year highs, China’s renewed efforts to curb declines in its currency are doing little to stop yuan bears who have sent forward devaluation expectations to record highs and options positioning to six-month lows. And judging by Goldman Sachs' outlook - a potential resurgence in Chinese growth fears early next year, but more broadly, a continued bumpy deceleration - things are not getting better anytime soon.

A few weeks ago we asked whether CalPERS would rely on sound financial judgement and math to set their rate of return expectations going forward or whether they would cave to political pressure to maintain artificially high return hurdles that they'll never meet but help to maintain their ponzi scheme a little longer (see "CalPERS Weighs Pros/Cons Of Setting Reasonable Return Targets Vs.

Just days after raising its economic outlook, Japan's ministry of finance announced on Thursday that for the first time since 1998 it would slash government bond issuance in fiscal 2017 which starts on April 1. The MOF plans to issue Y154.0 trillion in JGBs in coming fiscal year, down 5% from an initial Y162.2 trillion for the current fiscal year, as a result of sliding demand for debt amid continued very low to negative interest rates.

The JGB plans also feature a rare year-on-year cut in the issuance of 10-year JGBs: such a reduction is the first since fiscal 1998.

Italy's Monte Paschi isn't the only institutions that is about to soak retail investors who thought that two bailouts for Italy's third biggest bank in two years wouldn't be followed by a third nationalization in year #3. According to the South China Morning Post, a Chinese multi-billionaire businessman has defaulted on bonds worth a paltry 100 million yuan ($14.4 million) that he raised from retail investors, citing "tight cash flow", according to reports.