Bank of America Analyst Thinks We're Reliving the 1950s, Sees 'Decades' of Gains Ahead

If you thought the recent rally was awesome, you haven't seen anything yet -- according to BofA/Merrill analyst Stephen Suttmeier.

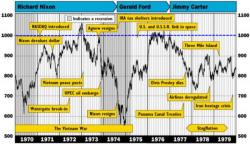

Stephen doesn't concern himself with the fact that the United States and its trading partners are now beguiled by trillions in debt and productivity losses not seen since the early 1980s. Instead, he fashions this to be equal to the golden age of economic prosperity, last enjoyed post world war 2 -- stretching until 1971.

WE HAVE FUCKING DECADES OF GAINS AHEAD.