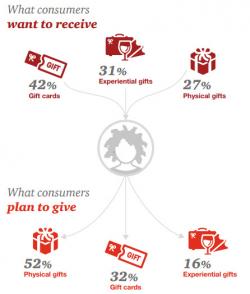

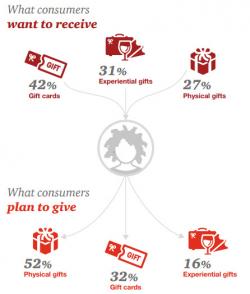

Millennials' Holiday Wish List

Via ConvergEx's Nicholas Colas:

Via ConvergEx's Nicholas Colas:

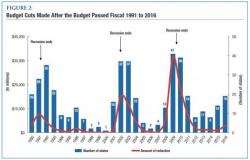

A decline in state tax revenue has historically been a reliable leading indicator of impending recessions. As such, investors/gamblers in the current equity market bubble should probably take note of the new report just published by the National Association of State Budget Officers indicating that state revenues are just starting to decline as funding needs related to massively underfunded pensions, rising education costs, etc. continue to skyrocket.

After two weeks of huge builds at Cushing (most since 2008), expectations were for a 3rd big weekly build at Cushing (and draw in overall crude). Oil prices kneejerked lower as API reported a major build in overall crude inventories (4.68mm build vs expectations of a 1.5mm draw). While Cushing saw a smaller than expected build, Gasoline inventories also soared most since January.

API

Today at 4:15pm ET (1:15pm PT), bond king Jeff Gundlach will hold his monthly webcast titled appropriately "Drain the Swamp."

In his latest media statement, Gundlach - who predicted the Trump presidency and the resultant bond selloff - turned decidedly more bearish, telling Reuters on December 2 that "stocks have peaked," although the market clearly has disagreed for now.

Dow 20,000 teases everyone ahead of The Fed...

http://www.youtube.com/watch?v=FsqJFIJ5lLs

Trannies and Small Caps underperformed as The Dow pushed on once again to new record highs (Nasdaq best on the day)

Stocks were spooked in the last few minutes as The ECB denied Monte Paschi's capital plan...

While The Dow failed to make 20k today, we note it is up over 2000 points from the pre-Trump lows...

With Goldman accounting for over 20% of all those gains...