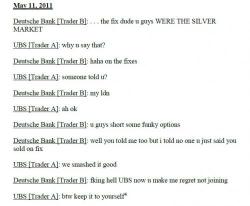

Silver Fixing By Banks Proven In Traders Chats

Silver Bullion Manipulation By Banks Proven In Traders Chats

Silver Bullion Manipulation By Banks Proven In Traders Chats

UniCredit announced on Tuesday a major restructuring plan to raise €13 billion in capital to return the Italian bank to profitability, hoping that a balance-sheet cleanup and cost cuts will persuade investors that Italy’s biggest bank can restore profitability even without much revenue growth. As part of the three-year strategy, the bank plans to shed an additional 6,500 jobs, bringing the total to 14,000, as it aims for 1.7 billion euros of annual cost savings.

Yesterday's brief hiccup in what has been an otherwise relentless rally in global risk assets is all but forgotten this morning, as European and Asian stocks, and US equity futures, all rise in quiet trading ahead of tomorrow's FOMC meeting, with the Dow set to make a 16th consecutive post-election all time high.

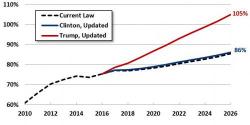

The driving catalyst behind the furious market rally since the presidential election has been the market's hope that Trump will unleash a "huge", still undetermined, debt-funded financial stimulus package, which will grease the volatile handover from monetary to fiscal policy, boosting inflation and rerating risk assets higher. Indeed, the market was so transfixed by this hope, that it has so far ignored all warning signs, duly noted previously on this website.